How They Pulled Off The Alleged Scheme

Excellent quick breakdown of one of the biggest frauds in U.S. history...which helped lead to the U.S. economic collapse...under George W. Bush.

ABSOLUTELY CRIMINAL !

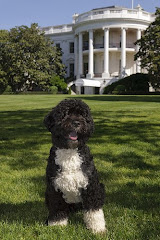

THIS is the kind of mess (corruption) that President Obama stepped into and is working diligently to clean up...while the corrupt work diligently to obstruct.

From HuffPo

In 2007 Goldman Sachs created what is known as a "synthetic collateralized debt obligation," or CDO, called "ABACUS 2007-AC1," which we'll call Abacus. It was one of many.

Goldman invited its clients to invest in Abacus, explaining in marketing materials that the $2 billion CDO was based on 90 bonds derived from subprime mortgage loans made over the previous 18 months.

If people whose mortgages make up the bonds in Abacus keep up with their house payments, then folks who invest in Abacus -- typically banks, insurance companies, and pension fund managers -- will make money.

The financial industry jargon for those investors' position is that they are "long." They're optimistic that the underlying borrowers won't default.