President Extends Foreclosure

Programs for Unemployed

From Bloomberg:

Unemployed homeowners with mortgages backed by the Federal Housing Administration or participating in a federal foreclosure prevention program will be given up to a year of forbearance on mortgage payments, the Obama Administration announced today.

Banks must increase the amount of time delinquent homeowners who are looking for work can gain relief from paying their mortgage from three or four months to at least 12 months, U.S. housing regulators said. Unemployment is a top reason borrowers fall into arrears.

A few months is “inadequate for the majority of unemployed borrowers,” Housing and Urban Development Secretary Shaun Donovan said. Sixty percent of the unemployed have been out of work for more than three months and 45 percent have been out of work for more than six, he said in a written statement.

The new rules apply to lenders who sell FHA-guaranteed mortgages and servicers participating in the administration’s Making Home Affordable foreclosure-prevention program.

The unpaid payments are added to the cost of the loan and must be repaid with interest.

Donovan said he hoped the announcement would prompt all loan servicers, including government-controlled Fannie Mae and Freddie Mac, to extend longer forbearance to the unemployed. “Our hope is that this will have broader effects,” Donovan said in a conference call.

“What we’re trying to do here is set the right standard,” Treasury Assistant Secretary Tim Massad said on the call.

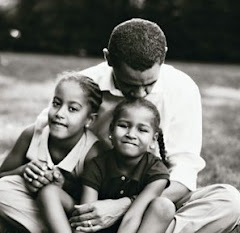

President Barack Obama yesterday said the administration is putting pressure on banks to modify more loans.

“The continuing decline in the housing market is something that hasn’t bottomed out as quickly as we expected, and so that’s continued to be a big drag on the economy,” Obama said during a Twitter town hall forum.

The Labor Department today reported that initial jobless claims fell by 14,000 to 418,000 in the week ended July 2.